Key Features

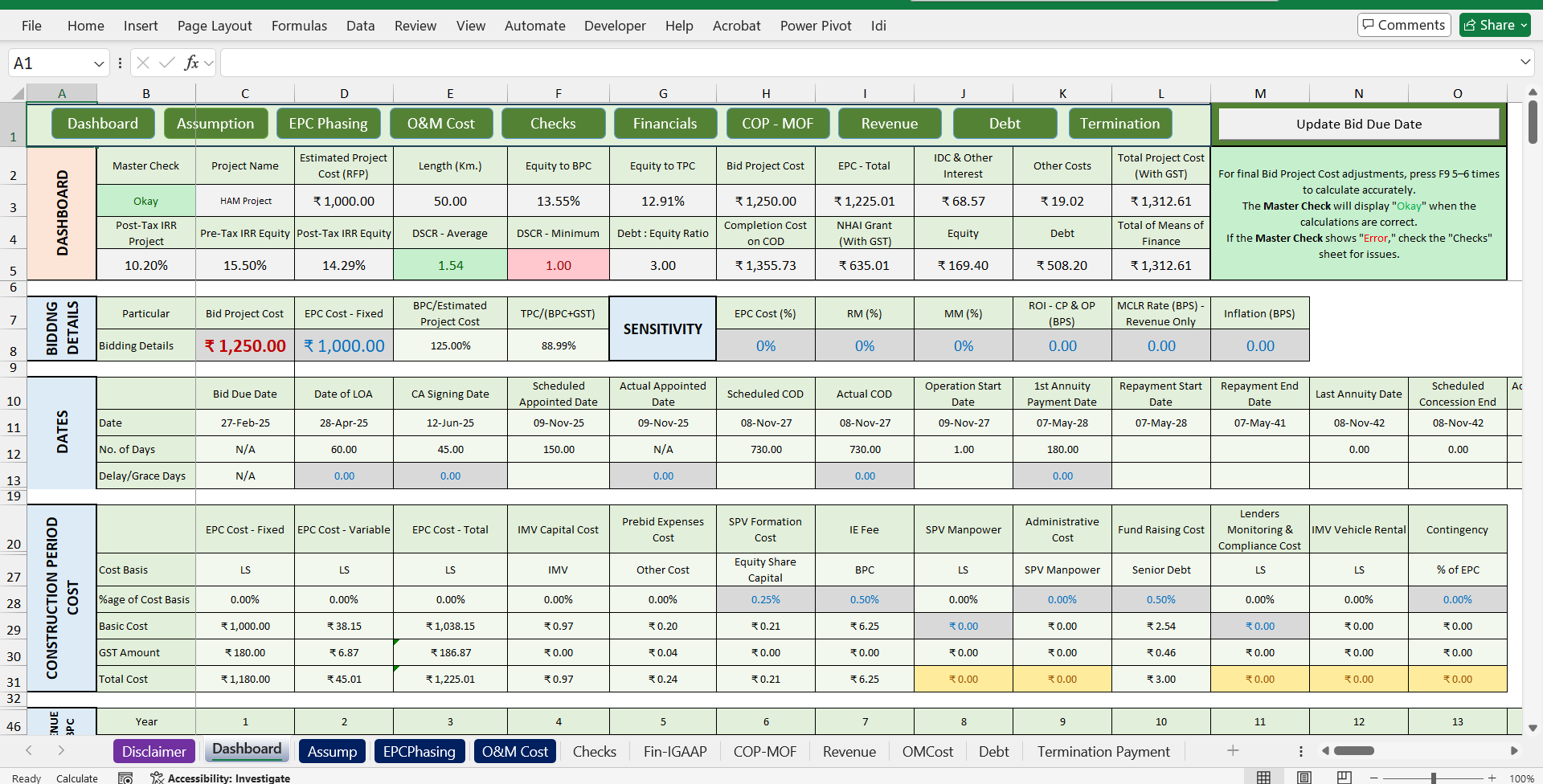

Digi Advisor offers digital products designed to simplify and enhance the financial modelling process for PPP Road-HAM infrastructure projects. These products ensure efficiency and accuracy throughout the pre-bid process.

Digi Advisor offers digital products designed to simplify and enhance the financial modelling process for PPP Road-HAM infrastructure projects. These products ensure efficiency and accuracy throughout the pre-bid process.

Saves time and reduces errors by providing preset values, with flexibility for limited customisation to fit specific project estimates.

Allows users to enter cost estimates, explore different Bid Project Costs, and test various scenarios such as loan repayment, DSRA, and EPC phasing.

Instantly generates accurate IRR and cash flow analyses, streamlining the process and ensuring efficiency.

Facilitates assessment of multiple financial strategies, helping users identify the most optimal bid structure.

Features robust security measures to ensure that user inputs and results are fully protected.

Hybrid Annuity Model

Road HAM (Hybrid Annuity Model) projects are a pivotal public-private partnership (PPP) initiative in India’s road infrastructure development. Combining the strengths of the EPC (Engineering, Procurement, and Construction) and BOT (Build-Operate-Transfer) models, HAM ensures a balanced approach to risk-sharing.

Under this model, the government finances 40% of the project cost during construction, while the private developer covers the remaining 60% through a mix of equity and debt. Developers benefit from fixed annuity payments from the government over a concession period of 15-20 years, minimizing revenue risks compared to toll-based models. Ownership of the project remains with the government throughout.

HAM promotes high-quality construction and timely project completion through milestone-linked payments and performance-based metrics. While it provides financial stability and mitigates risks for private players, challenges such as delayed government payments and land acquisition hurdles remain. Despite these challenges, HAM has proven to be a sustainable and effective model for expanding India’s road infrastructure.

Public-Private Partnership (PPP) Hybrid Annuity Model (HAM) projects require detailed financial analysis before bid submission. However, bidders often encounter the following challenges:

Navigating the intricate Hybrid Annuity Model (HAM)

structure with multiple revenue streams and financial variables.

Underestimating Operations and Maintenance (O& M)

costs, which can strain long-term project sustainability.

Without a reliable and comprehensive financial model, bidders may face:

Misjudging EPC costs relative to total capital costs may result in bids that fall below the Authority Cost, causing financial losses.

Failure to simulate financial scenarios like IRR, debt repayment, or cash flow management may lead to overlooked risks or overly conservative bids.

Inaccurate cost or revenue estimations, or misjudged EPC phasing, can lead to financial losses, non-compliance, or unexpected budget overruns.

Inadequate financial projections for Operations and Maintenance (O&M) can leave bidders unprepared for long-term commitments.

Errors in calculations and non-compliance with tender requirements can damage reputations and exclude bidders from future opportunities.

Poorly optimised bid strategies reduce the attractiveness of submissions, putting bidders at a disadvantage against competitors.

Digi Advisors, powered by Infra-Advisors, offers the ultimate financial modelling tool designed to simplify and streamline the pre-bid process for PPP Road Hybrid Annuity Model (HAM) projects.

With 15+ years of experience advising on over 400+ infrastructure projects, Digi Advisor leverages Infra-Advisors’ expertise in financial evaluations, bidding strategies, and risk assessments to ensure informed decision-making.

Includes key concession agreement terms, standard cost components, and industry benchmarks to save time and reduce errors, with flexibility for customisation to fit specific project needs.

Allows users to simulate a range of financial scenarios, evaluate IRR, cash flows, debt structuring, and more, ensuring thorough risk assessments and strategic planning.

Supports various approaches to project structuring and financial planning, enabling bidders to develop optimal strategies for both bid submission and long-term success.

Each model is customised to meet the unique requirements of the project, providing precise analysis and actionable insights for better decision-making.